We wake up every day thinking that we just do our job. I don’t know what job you have. You could be a CEO of a global firm, or a PA to the CEO, or a housekeeper of the PA to the CEO, or …well, you get the idea. But every day, whoever and wherever you are, you could change the world.

This was typified by the classic story of John F. Kennedy visiting NASA during the moonshot development in the 1960s. During his visit, he noticed a janitor carrying a broom. He walked over to him and said “Hi, I’m Jack Kennedy. What are you doing?” The janitor responded, “Well Mr. President, I’m helping put a man on the moon.”

This clearly linked the whole organization to a purpose and a focus. Does your company have this purpose and focus? If not, should you create it? My answer would be yes, but you can’t create a purpose from thin air. You can’t create a purpose from some made-up mantra. You can’t create a purpose that you don’t believe in wholeheartedly.

The people now walking your corridors and visiting your office, need something to believe in that is more than just ROI. It’s return to stakeholder, not just shareholder.

This is the challenge for leaders worldwide. As consumers and citizens disengage from corporations and governments, how can you create a movement that they do believe in? This is particularly true amongst Gen Z but also Millennials. The people now walking your corridors and visiting your office, need something to believe in that is more than just ROI. It’s return to stakeholder, not just shareholder.

The pressure to do this has specifically intensified since we have seen global movements like the rise of Extinction Rebellion and leaders such as Greta Thunberg. The activist consumer – one of your key stakeholders – and the activist investor – your pension funds and institutional investors – are far more aware of ESG today than ever before.

But ESG (that is, Environmental, Social and Governance) is just an investor term. Does it mean anything to you? What should it mean? What can you do about it?

For me, the pressure groups – both governmental and non-governmental – are not the issue. The issue is the customer, the employee and the stakeholders. How can I give RTS: return-to-stakeholder?

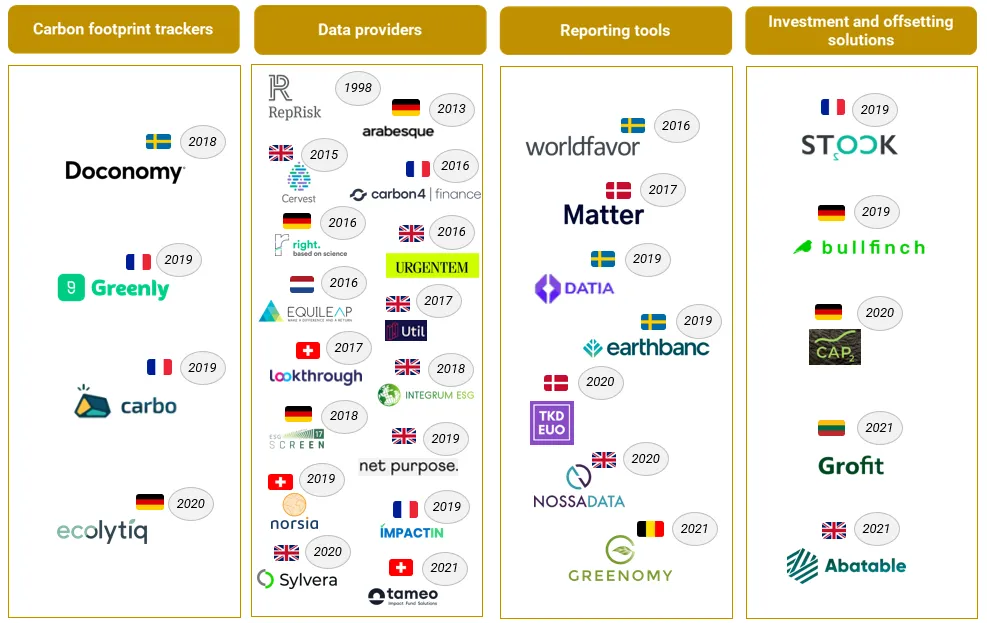

Right now, there’s a great opportunity to do just that by combining technology and finance to make the world a better place. Sounds pithy? It’s not, and there are hundreds of start-up firms doing just this. Here are a few examples:

Figure: The B2B players helping businesses and financial institutions to work greener (source: Medium, Nov 2021)

These greentech start-up companies, of which there are more every day, recognize that you can combine ethical finance, environmental and biodiversity issues with technology to make the world a better place. Banks can do the same, and many are.

These greentech start-ups recognize that you can combine ethical finance, environmental and biodiversity issues with technology to make the world a better place. Banks can do the same.

For example, during the past year, four out of five big banks and three of Europe’s top ten said ‘no’ to investments in new fossil fuel projects, including HSBC, Lloyds Banking Group and NatWest.

The banks are responding to consumer pressure but, more importantly, investor pressure. The challenge however is that, if you do stop investing in fossil fuels, what do you do instead?

European banks generate almost 15 percent of their profits from fossil fuel firm lending. If that disappeared tomorrow, what’s the alternative and is it worth it?

It’s interesting to then think about the fact that you can combine finance and technology to make money out of renewables, carbon offsets, linking industries and using technology to monitor the world in real time.

I have a number of favorite examples in this space, such as Rabobank in the Netherlands linking agricultural technologies – such as tracking crop growth, rainfall and pollution for a successful harvesting season – with their insurance services for farmers. Another favorite is the Finnish bank the Bank of Åland, who created a fantastic green payments system to support improvements to the Baltic Sea. But maybe my favorite greentech story – and yes, that’s a thing – is Ant Forest.

You may have heard of Ant Forest, but if not, it is the company behind the largest payment system in China, Alipay. For context, in the 12 months leading to June 2021, Alipay processed 118 trillion yuan in total transactions and, in 2022, some estimates that over a trillion RMB ($150 billion) of payments were transacted on Singles Day alone. Singles Day is kind of the Chinese equivalent of Black Friday in America, and encourages everyone to buy during a 24-hour window on 11th November. It’s an amazing company with amazing scale.

If you buy products wrapped in cardboard rather than plastic, you get points; if your water bill shows you are reducing usage at home, you get points; and so on. Using gamification, Ant Forest has helped plant more than 326 million trees since it launched in 2016.

One day a few years ago, an employee came up with an idea that if every time a Chinese citizen paid for something, maybe we could tell them whether it was environmentally friendly. For example, if you paid for parking your bicycle, you get more points than if you pay to take a taxi, bus or car; if you buy products wrapped in cardboard rather than plastic, you get points; if your water bill shows you are reducing usage at home, you get points; and so on. And what do points make? Trees!

By summer 2021, Ant Group announced that they had helped over 600 million users plant more than 326 million trees since it launched in 2016. Oh, and Ant’s system is using gamification to make customers more climate friendly. In other words, with 600 millions users, Ant has one of the largest gaming systems in the world – all integrated between technology and finance. That’s why it’s one of my favorite greentech fintech systems!

In summary, the world is changing fast and many start-up companies are recognizing that they can make the world a better place through technology and finance. Banks are also being forced into this space by their investors and customers, and can equally reinvent their businesses to leverage technology and finance for future returns to all stakeholders, and not just shareholders. Where would you rather be?

///

About the author

Chris Skinner is known as one of the most influential people in technology. He is an independent commentator on the financial markets and fintech through his blog, the Finanser.com, which is updated daily and as a best-selling author. His latest book is Digital for Good, which explores the themes of this column in far more depth.